In 2018, CipherBio created the world’s first life science ecosystem database to help its members — companies, accelerators, and investors — reach their goals and propel the industry to the next level.

As it is the first time that we have access to a full year’s data across different life science accelerators, we decided to shine a spotlight on these unique entities and their indispensable intermediary role in the ecosystem.

What 2019 Tells us About Life Science Accelerators

The data shows us that accelerators matter. Here are the key takeaways about top life science accelerators:

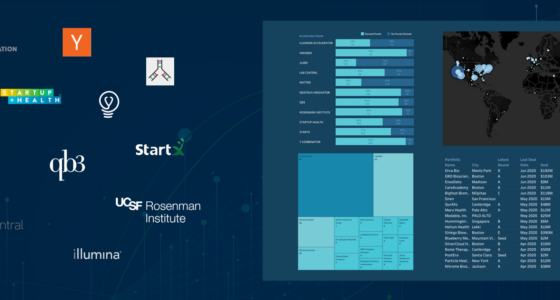

1. The Top Life Science Accelerators

Table 1 illustrates the top 8 accelerators (in alphabetical order) active in the life science ecosystem. It clearly shows that the sector is dominated by those that specialize in this sphere — with 7 out of 8 being focused on life science or founded by life science companies or university research centers. The only generalist on the list is Y Combinator.

Table 1: Number of Life Science Companies in Top Accelerators; Source CipherBio 2020

Mentorship is one of the most valuable benefits of an accelerator program. Specialists can leverage industry-specific expertise and connections for the companies they support. Often founded by companies and led by experienced experts from the industry, these accelerators will have a mentorship network tied closely to the life science field.

However, Y Combinator is not on this list by chance. Being the oldest accelerator in the US, Y Combinator can offer a range of benefits to life science companies. As much as it’s a generalist, Y combinator has shown a special knack for biotech and has been a significant player in the field.

Y Combinator’s history with the life science industry goes back to 2014 when it backed its first biotech company, Ginkgo Bioworks, an MIT-affiliated synthetic biology company that designs microbes for commercial use. Ginkgo Bioworks went on to become a biotech unicorn valued at more than $4 billion. Y combinator has since expanded into all areas of the life sciences — now holding 147 companies in its portfolio — and funding more seed-stage biotech companies than any other investor.

2. Top Accelerators’ Companies Which Raised Funds

Table 2: Top Accelerators’ Portfolio Companies Which Raised Funds; Source CipherBio 2020

Table 2: Top Accelerators’ Portfolio Companies Which Raised Funds; Source CipherBio 2020

Table 2 illustrates the proportion of top accelerators’ portfolio companies that raised funds. While JLABS’ portion of companies that raised investment is on the lower side (14%), it is still a considerable number of companies (62), and the amount raised tends to be significantly higher as this accelerator’s companies participated in 10 out of 15 top deals (Table 4 further in the article). Likewise, Startup Health, the second-largest accelerator, has a 7% rate (14 companies), but one of them- Devoted Health- raised $300 million in 2019.

3. Accelerator Portfolio Companies that Raised a Series A Round in 2019 or 2020

Table 3 illustrates the contribution of each of the top accelerators to the total number of companies that raised Series A since the beginning of 2019.

Table 3: Top Accelerator Companies That Raised Series A in 2019 and 2020

Of 143 Series A deals since the beginning of 2019, top accelerator portfolio companies made up almost a third of them (44).

4. Top Deals and Exits for Accelerator Portfolio Companies

When we dive into the top 15 accelerator-affiliated companies by deal size (Table 4) and look at what is common for them, a pattern will start to emerge – we can see that this space is dominated by the same usual suspects: JLABS, QB3, Lab Central, Startup Health, Illumina and Y Combinator. Some of the accelerators go on to make late-stage investments in their portfolio companies, such as Y Combinator in Ginkgo Biowork’s Series E and Illumina in Helix’s Series B.

Table 4: Top Companies by Deal Size; Source CipherBio 2020

Biotech was the top performer. All the top deals were from the biotech sphere, except Devoted Health (healthcare) and Helix (digital health). The driving force behind this fact lies in the distinctive nature of biotech compared to the medical device, diagnostic, and digital health companies.

First, unlike medical device companies, biotech companies usually get sold before drugs reach marketing approval. The long development times for medical device companies can lower investor interest.

Second, biotech differs from other life science verticals as companies tend to have low early-stage valuations before they suddenly experience explosive growth, becoming exponentially more valuable as they receive positive research results and get closer to the commercialization stage.

Interestingly, if we zoom out to capture a wider view of the life science scene beyond top deals, this finding holds true — biotech is the most prominent vertical across the board for transactions closed in 2019 and 2020.

In 2019, out of 417 VC deals, biotech contributed 208, followed by digital health (104), medical devices (70), and diagnostics (35).

Since the start of 2020, there were 89 VC deals, with more than half of them in biotech (45), followed by digital health (19), medical device (13), and diagnostics (12).

Top Acquisitions of Accelerator Companies

The two top deals in Table 3 were recent acquisitions – BlueRock Therapeutics, and Tilos Therapeutics.

BlueRock Therapeutics is a Toronto-based preclinical biotech company (incubated by JLABS) developing engineered cell therapies in neurology, cardiology, and immunology. It was acquired by Bayer in August 2019, with a valuation of $1 billion. The company raised $225M in Series A funding the same year it was founded (2016) from investors such as Versant Ventures, a leading healthcare investment firm, and Leaps by Bayer.

Tilos Therapeutics was a preclinical company developing treatments of cancer, fibrosis, and autoimmune diseases acquired by Merck in June 2019. Founded in 2016, Massachusetts-based Tilos Therapeutics had only raised $9.5 million in seed financing before Merck struck a massive $773 million deal to buy the company. Tilos was a portfolio company of Lab Central, and its seed investors included Partners Innovation Fund and Boehringer Ingelheim Venture Fund.

Partners Innovation Fund is an early-stage VC fund created in 2008 to support the commercialization of research efforts by Partners’ academic institutions which include two of the nation’s leading academic medical centers – Boston’s Brigham and Women’s Hospital and Massachusetts General Hospital. As a life science-focused investor, Partners’ portfolio includes biotech companies such as Keros Therapeutics, Nocion Therapeutics, and Encendia Therapeutics Inc. as well as Magenta Therapeutics. Magenta Therapeutics is a high-profile clinical-stage biotech company founded in 2015 to develop immune system based therapeutics to cure devastating and life-threatening diseases. Magenta went public in 2018, raising $100 million with a valuation at IPO of $515 million. Prior to its IPO, Magenta had secured three successive rounds (Series A, B, and C) of funding in three years.

The other Tilos’ seed investor, Boehringer Ingelheim Venture Fund, is the strategic venture fund of the Boehringer Ingelheim Corporation, the world’s largest private pharmaceutical company. Its mainly European focused portfolio includes notable investments like Abalos Therapeutics, OncoMyx Therapeutics, Eyevensys, and HepaRegeniX.

Life Science IPOs of Accelerator Companies

In 2019 there were two IPOs among accelerator companies: Alector and Ideaya Biosciences.

Alector (founded 2013), a San Francisco based clinical-stage company taking an immunotherapy approach to Alzheimer’s disease and other brain disorders, went public in February 2019, raising $176 million at a $1.3 billion valuation. Alector is a graduate of two top accelerators – JLABS and QB3.

Ideaya Biosciences (founded 2015), is another San Francisco Bay Area biotech company focused on oncology precision medicine. It went public in May 2019, raising $50 million at a $195 million valuation. Before going public, it had raised almost $150 million through three rounds of investments. Ideaya is a graduate of the JLABS accelerator.

5. The Investors Every Accelerator Life Science Company Needs to Watch out For

The final table brings us invaluable insight for companies trying to make their way in life science landscape – the top 17 investors in accelerator companies (Table 5).

Table 5: Top Life Science Investors in Accelerator Companies

Table 5 shows that out of 17 top accelerator companies investors, VC companies represent by far the largest investor class, both in terms of the contribution to the total investor count (9), and in terms of the deals they closed (106 out of 200). They are followed by corporate VC arms (5 CVC companies and 49 deals) and accelerators (3 accelerators and 45 deals).

As Table 5 illustrates, independent VCs that invested in accelerator companies don’t tend to be life science specialists, since only three out of ten have explicit life science focus (Mission Bay Capital, Atlas Venture and OS Fund). On the other hand, corporate VCs tend to be linked to the life science industry (Pfizer Ventures, Johnson & Johnson Innovation, GE Ventures, and Alexandria Venture Investments).

However, as life science started exhibiting features reminiscent of software companies before the sector experienced sudden growth – costs and cycle time significantly decreasing – the presence of tech corporate VCs in life science space started to emerge. As a result of this nascent trend, in 2019 we see Google Ventures joining specialists like Pfizer, Johnson & Johnson Innovation, and GE Ventures.

The biggest individual investor in accelerator incubated companies is Y Combinator with 20 deals. The second, Khosla Ventures, is a venture company founded in 2004 by Vinod Khosla, the co-founder of Sun Microsystems and the general partner of KPCB, which sealed 18 deals. They are closely followed by Mission Bay Capital, a venture firm focused on early-stage investments in bioscience companies (17). SOSV, a venture company that runs multiple accelerator programs, providing seed, venture, and growth-stage investment, totaled 13 deals. Viking Global Investors, an investment company focused primarily on public and private equity interests also came in at 13. Stanford’s StartX Fund, focused on tech and MedTech companies, completed 12 deals.

Large corporations demonstrate a significant presence in the life science innovative ecosystem, with corporate venture programs such as Pfizer Ventures (11), GE Ventures (10), and Johnson & Johnson Innovation (10) ranking quite high.

Liquid2, a tech-focused seed-stage VC firm built by a team of ex-founders, reached ten deals. As did AME Cloud Ventures, led by the co-founder of Yahoo!; Atlas Venture, a biotech focused company; and OS Funds, an investment company specialized in genomics, synthetic biology, and bio IT.

Alexandria Venture Investment, a real estate company, focused on serving the life science industry; Fifty Years, a company backing the Sustainable Development Goals; Data Collection, VC firm focused on tackling the world’s largest problems through data; and Google Ventures – all sealed nine deals.

What’s Next

Accelerators, being positioned between companies and investors, are an integral component of the life science ecosystem. Their role goes well beyond matchmaking as they provide all-round general and specialist support for entrepreneurs poised to turn science into business.

With this in mind, CipherBio is committed to working with accelerators to track, aggregate, and analyze life science data to help actors effectively navigate today’s life science landscape.

Join us in our Quest for the Data-Driven Life Science Ecosystem

As we set out to solve for the industry’s lack of publicly-available data on startup outcomes from accelerators, we expect our database to deliver an increasing number of insights.

If you are a life science company tied to an accelerator, please join the platform and help us develop the first database that will enable the life science industry to leverage aggregate data.

Fill out your digital profile, or update it with your company’s latest news, so that you can be a part of the data set that represents the life science ecosystem.