Co-authored by Matt Gibbs @cipherbio_gibbs, Barbara Alcaraz Silva SVB VP, and Kaitlin Berube SVB VP.

The third quarter of 2020 remains a challenging time for the global economy, still strongly influenced by the effects of the pandemic — although businesses around the world appear to gradually adjust to the new normal.

While economic fallout from the pandemic continues to hit countries around the world, wiping out large swaths of the global economy along the way, the life science sector continued to flourish and accelerators proved indispensable in the process. As an essential element of the innovative ecosystem, life science accelerators and incubators are adapting their roles to the new environment as they commit to support scientific entrepreneurship when humanity needs it most.

CipherBio data shows that in 60 deals involving companies affiliated with top accelerators and incubators, approximately $2B were raised in Q3 2020—with more funding coming in. With COVID-19 demonstrating the sector’s vital role more than ever, life science companies spent the third quarter collaborating with investors and accelerators to fulfill their mission by bringing science, technology and capital together.

CipherBio data platform leverages access to funding data across over 6000 life science companies, 3300 investors and 1600 global fundraising announcements. We took a deep dive into the wealth of data we collect and aggregate in the CipherBio platform to explore how the most prominent life science accelerators and incubators fared in the third quarter of the current year and put those findings into a broader context by comparing them to the 2020 YTD.

JLABS

538

MEDTECH

INNOVATOR

340

STARTUP

HEALTH

333

Y

COMBINATOR

284

MATTER

168

QB3

165

STARTX

148

LAB

CENTRAL

135

INDIEBIO

104

ROSENMAN

INSTITUTE

73

ILLUMINA

ACCELERATOR

45

TECHSTARS

16

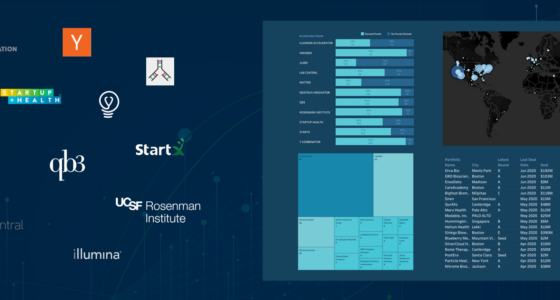

Figure 1: The List of Major Accelerators and Incubators (As Per the Number of Portfolio Companies); Source CipherBio, November 2020

With 538 companies in its portfolio, J&J Innovation – JLABS is the largest incubator on the list. Being primarily focused on Biotech, this world-renowned incubator is collaborating with 333 companies from this vertical, while Medical Devices account for 118, Digital Health/AI for 64 and Diagnostics 23 companies (as of November 2020).

This global network of open innovation ecosystems across a broad healthcare spectrum – from pharmaceutical and Medical Devices to consumer and health tech sectors – works to create and accelerate the delivery of life-saving and life-enhancing health and wellness solutions to patients worldwide.

Consistently at the forefront of the global life science research, J&J Innovation – JLABS launched Blue Knight – a joint initiative with the Biomedical Advanced Research and Development Authority (BARDA) created to look beyond the current pandemic and stimulate and accelerate innovation to improve long-term global health security by preventing and effectively managing future infectious disease threats. With that aim in mind, seven J&J Innovation – JLABS’ portfolio companies were selected to fill gaps in the current set of available COVID-19 diagnostic, therapeutic, vaccine and other technology potential solutions. These are 7 Hills Pharma, Autonomous Therapeutics, Inc., Epic Bio, Gabi SmartCare, Genome Biologics, Persephone Biosciences, Inc. and Specific Biologics Inc..

With 340 portfolio companies, MedTech Innovator is the largest accelerator on this list. As the largest accelerator of medical devices in the world, MedTech Innovator primarily works with companies from this vertical – the CipherBio profile shows that it is associated with 250 Medical Devices companies, equivalent to almost three-quarters of its portfolio.

Although focused on the Medical Devices space, as one of the most active industry actors, MedTech Innovator also works with Biotech (31), Digital Health/AI (48) and Diagnostics (11) companies with the mission to unite leading players in the innovation ecosystem to improve the lives of patients by accelerating the growth of companies that are transforming the healthcare system. Since its inception in 2013, MedTech Innovator has graduated 340 companies that have gone on to raise more than $2 billion in follow-on funding and bring 74 products to the market.

Today, this prominent accelerator works with some of the most promising innovative companies in the Medical Devices vertical, shaping the future of the space. For example, Rhaeos, a medical technology startup based in Evanston, Illinois, is developing a wearable for improving the monitoring of hydrocephalus patients. Founded in 2018 as a result of the collaboration between materials scientists and neurological surgeons at Northwestern University, Rhaeos was named 2020 Global Competition Winner at The MedTech Conference. This innovative company developed a noninvasive thermal sensor to monitor ventricular shunt function since neurosurgically implanted shunts—the standard treatment for hydrocephalus patients—often fail with life-threatening consequences. Rhaeos’ groundbreaking solution for patients suffering from hydrocephalus—estimated at 1M Americans today—hopes to eradicate the uncertainty faced by patients, families and healthcare providers.

Another company applying science to tackle the world’s toughest healthcare challenges under the wing of MedTech Innovator is 7D Surgical. This innovative company develops advanced optical technologies and machine vision-based algorithms to improve the surgical workflows and precision of imaging technology in brain and spinal surgery, with the potential to bring similar future advancements in other surgical specialties.

As one of the most notable players in the life science ecosystem, MedTech Innovator works with scientific ventures across the world—from the US to Europe and Asia. Some of its London-based Medical Devices portfolio companies include Circadia Health, which develops solutions for early detection of respiratory complications using contactless sensing and AI-powered technology and Kheiron Medical Technologies, a company developing deep learning solutions to detect breast cancer earlier. Other European companies include Paris-based LimFlow SA, a company designing solutions to restore blood flow to the ischemic foot and Dublin-based SepTec, a company working on designing the next generation of sepsis diagnostics. In the Asian region, MedTech Innovator works with companies such as Bloom Standard, a Hong Kong-based company developing AI-powered essential imaging for medically fragile children and Grace imaging Inc., a Tokyo-based company developing advanced fatigue measurement service by lactic acid sensing in sweat and MRI technologies

The third place is occupied by StartUp Health, a New York – based accelerator supporting health-focused entrepreneurs at any stage of growth across 24 countries and six continents and 11 categories. With more than 300 portfolio companies from the Digital Health/AI vertical—equivalent to around 90% of the total portfolio—this renowned accelerator is clearly focused on this space..

It is followed by Y Combinator which manages a portfolio of 284 companies. Although a tech accelerator by its nature, Y Combinator is open with its intention to expand aggressively into all areas of life science space. Since 2014 when it funded its first biotech company, Ginkgo Bioworks, which went on to raise $390M in funding so far from investors such as T. Rowe Price, Cascade Investment LLC, Viking Global Investors, General Atlantic LLC, and Y Combinator, the first-ever US tech accelerator has funded over 250 biotech, healthcare, and life science companies—which makes it one of the largest seed-stage bio/healthcare funders in the world.

The complete list of major life science accelerators and their respective company count is outlined in Figure 1.

How Many Accelerators’ Portfolio Companies Raised Funds

Top Deals: Q3 2020 Data

The biggest transactions in the third quarter of 2020 include two Biotech deals above the $200M mark. The first is Zymergen’s $300M Series D led by Baillie Gifford and backed by Baron Capital and Perceptive Advisors, and the second is Freenome’s $270M Series C led by Bain Capital and Perceptive Advisors and joined by Fidelity, Janus Henderson, Farallon Capital Management and Rock Springs Capital. The former is associated with QB3, while the latter is a StartX company.

Encoded Therapeutics Inc, an Illumina Accelerator and QB3 alumni developing precision gene therapies for severe genetic disorders, closed a $135M Series D led by Matrix Capital Management and Surveyor Capital and joined by Adage Capital Management, Cormorant Asset Management, Farallon, totaling $239M of raised funds.

Two Biotech companies made a notable private market debut with sizable Series A rounds in Q3 2020 and they are both related to LabCentral. These are Kronos Bio, a Cambridge, MA-based precision medicine Biotech company raising a $155M Series A led by Perceptive Advisors and backed by Casdin Capital, Commodore Capital, EcoR1 Capital, and Dyne Therapeutics, a Biotech developing treatments for muscle diseases which raised $115M from Forbion, MPM Capital, Atlas Venture.

Annexon, a JLABS-associated company developing treatments for neurodegenerative disease, raised $100M from Redmile Group with Support from BlackRock, Deerfield Management Company, Eventide Asset Management (and went public raising $251M several weeks later).

Another JLABS-associated company with a sizable investment in Q3 is VelosBio, a clinical-stage Biotech company developing novel cancer therapies, which raised a $137M Series B in July 2020, increasing the total funds raised to $195M.

Next in line is Atomwise, a Y Combinator-related Biotech using AI to help discover new medicines and agricultural compounds which raised a $123M Series B led by Sanabil and B Capital Group and joined by Data Collective DCVC, Tencent Holdings, Y Combinator, Dolby Family Ventures, and AME Cloud Venture.

Other sizable deals sealed during Q3 2020 are listed in Figure 2.

Figure 2: Top Deals in Q3 2020 Involving Accelerators’ Portfolio Companies (excluding IPO deals); Source: CipherBio, November 2020

Figure 2: Top Deals in Q3 2020 Involving Accelerators’ Portfolio Companies (excluding IPO deals); Source: CipherBio, November 2020

Top Deals: Total Data Since 2019

With the CipherBio database expanding as we track new deals and collect their respective data, we update the list of top deals since 2019 involving companies affiliated with top life science accelerators. Figure 3 illustrates the updated all-time high list reflecting large deals sealed in Q3 2020 (excluding IPO deals) which put them in a broader context that includes the biggest deals in the sector since 2019.

New Q3 2020 additions to the list include deals such as Pionyr Immunotherapeutics, a California-based Biotech exploiting novel target discovery and antibody generation platform technologies to create the next generation of immuno-oncology therapeutics. This J&J Innovation – JLABS and QB3 alumni closed a $275M deal with Gilead Sciences under which the latter will buy a 49.9% equity stake, bringing the total funds raised by this innovative life science company to $345M (Figure 3).

Figure 3: Top Deals Involving Companies Associated with Most Active Accelerators (2019-2020 YTD, excluding IPO deals); Source: CipherBio, November 2020

Figure 3: Top Deals Involving Companies Associated with Most Active Accelerators (2019-2020 YTD, excluding IPO deals); Source: CipherBio, November 2020

VelosBio is another JLABS-associated Q3 2020 entrant. It is a clinical-stage Biotech company developing novel cancer therapies, which raised a $137M Series B in July 2020, increasing the total funds raised to $195M.

Orca Bio, a StartX’s Biotech developing high precision allogeneic cell therapies, has come out of stealth at the Q2-end with a $192M Series D backed by LightSpeed Venture Partners, 8VC and Data Collective DCVC.

LabCentral’s Kronos Bio, a private clinical-stage biopharmaceutical company dedicated to the discovery and development of novel precision medicine cancer therapeutics, closed a $155M financing led by Perceptive Advisors and Backed by Casdin Partners, Commodore Capital, EcoR1 Capital.

Encoded Therapeutics Inc, an Illumina Accelerator and QB3 alumni developing precision gene therapies for severe genetic disorders, closed a $135M Series D led by Matrix Capital Management and Surveyor Capital and joined by Adage Capital Management, Cormorant Asset Management, Farallon, totaling $239M of raised funds.

Another new entrant is Atomwise, a Y Combinator-related Biotech using AI to help discover new medicines and agricultural compounds which raised a $123M Series B led by Sanabil and B Capital Group and Joined by Data Collective DCVC,Tencent Holdings, Y Combinator, Dolby Family Ventures, and AME Cloud Venture. At the same time LabCentral’s Dyne Therapeutics also qualified for the table of top deals since 2019, receiving a $115M Series A from Forbion, MPM Capital and Atlas Venture.

Another Q3 2020 deal that made it to the list of all-time high deals since 2019 is 4D Molecular Therapeutics, Inc., a California-based Biotech developing targeted, customized next-generation AAV gene therapy for patients with severe genetic diseases, which raised $75 Million Series C led by Viking Global Investors. This is a second new entrant that is affiliated with JLABS and QB3.

Fulcrum Therapeutics Inc. a LabCentral-associated Biotech focused on developing small molecule therapies to treat rare genetic diseases, raised a $69M Series B round.

Bigfoot Biomedical, a MedTech Innovator-related Medical Device company developing technologies to significantly reduce the cognitive, emotional, and financial burden of insulin-requiring diabetes patients, raised a $55M Series C led by Abbott with support from Quadrant Capital Advisors, Senvest Capital, Janus Henderson.

Most active Life Science Accelerators and Incubators in Q3 2020

Figure 4: Top Deals Involving Companies Associated with Most Active Accelerators (2019-2020 YTD, excluding IPO deals); Source: CipherBio, November 2020

Figure 4: Top Deals Involving Companies Associated with Most Active Accelerators (2019-2020 YTD, excluding IPO deals); Source: CipherBio, November 2020

CipherBio data reveals that the list of most active accelerators in the third quarter of 2020 includes MedTech Innovator, J&J Innovation – JLABS, QB3, Y Combinator, IndieBio, LabCentral, StartX, Rosenman Institute, Illumina Accelerator and StartUp Health (Figure 4).

With 17 portfolio companies raising financing MedTech Innovator was the most active accelerator in Q3 2020. The most notable deals in Q3 2020 include Bigfoot Biomedical, a medical device company which closed a $55M Series C led by Abbott with Support from Quadrant Capital Advisors, Senvest Capital, Janus Henderson and Miracor Medical Systems, a European medical device company dedicated to improve clinical outcome of patients with impaired cardiac function, which raised a $28.4M in Series E Funding led by Yonghua Capital.

With 14 portfolio companies successful in raising funds, J&J Innovation – JLABS incubator is the second most active player during Q3 2020. The list of portfolio companies which raised funds in the third quarter include Pionyr Immunotherapeutics, Annexon, VelosBio and 4D Molecular Therapeutics, Inc.

J&J Innovation – JLABS is closely followed by QB3, the University of California’s hub for innovation and entrepreneurship in the life science space, with 12 companies successful in raising funds in the third quarter. Managing a total portfolio of 165 companies, QB3 is mainly focused on the Biotech vertical, with 85 companies from this space. Medical Devices follow with 50 companies, while Diagnostics (21) and Digital Health/AI (9) are considerably smaller.

QB3’s companies which raised funds in Q3 2020 include Zymergen, a California-based synthetic biology firm, raised $300M in Series D financing during Q3 2020, Encoded Therapeutics Inc which raised a $135M Series D led by GV and Mission Bio, a company solving complex biological problems with precision engineering, innovative biochemistry, and supported bioinformatics, which raised a $70M led by Novo Growth and backed by Soleus Capital, Mayfield, Cota, and Agilent.

The complete list of the most active life science accelerators and incubators in Q3 2020 is presented in Figure 4, while Figure 5 outlines the sectoral breakdown of companies which raised funds in the third quarter for each of the top accelerators and incubators.

Most of the successful companies associated with MedTech Innovator are from the Medical Devices vertical—which is understandable as this accelerator focuses on the medical devices space. Y Combinator has an almost equal split between Biotech and Digital Health/AI, which is also expected given this accelerator’s tech focus combined with its increasing interest in Biotech companies. Companies that managed to raise financing and are associated with J&J Innovation – JLABS, QB3, LabCentral, IndieBio and Illumina Accelerator are primarily from the Biotech vertical, while Rosenman Institute is focused on the Medical Devices vertical (Figure 5).

Figure 5: Top Deals Involving Companies Associated with Most Active Accelerators (2019-2020 YTD, excluding IPO deals); Source: CipherBio, November 2020

Figure 5: Top Deals Involving Companies Associated with Most Active Accelerators (2019-2020 YTD, excluding IPO deals); Source: CipherBio, November 2020

Most active Life Science Accelerators and Incubators in 2020 YTD

After giving a snapshot of developments in life science accelerators’ space during the last quarter, we next put these findings in the broader context and dive deep into the CipherBio data platform to explore how most active accelerators and incubators fared since the beginning of the year.

With 52 portfolio companies raising funds in 2020, the most active accelerator since the beginning of the year is MedTech Innovator. Apart from those sealed in Q3 2020, other notable deals in 2020 involving MedTech Innovator’s companies include Arterys, a Medical Device company which was the first to receive FDA clearance for a cloud-based product with Artificial Intelligence, raising a $28M Series C led by Temasek Holdings.

Figure 6: Most Active Life Science Accelerators and Incubators in 2020 YTD as per Number of Companies Successful in Raising Funds; Source: CipherBio, November 2020

Figure 6: Most Active Life Science Accelerators and Incubators in 2020 YTD as per Number of Companies Successful in Raising Funds; Source: CipherBio, November 2020

Register for a free CipherBio account to find exclusive life science industry insights.

J&J Innovation – JLABS, closely follows with 47 companies raising funds during the same time, including deals such as Pionyr Immunotherapeutics, Kymera Therapeutics, CARsgen Therapeutics, Annexon, Cortexyme, Inc., VelosBio and 4D Molecular Therapeutics, Inc.

With 44 life science companies at the start of their entrepreneurial journey under its wing, the third most active accelerator since the beginning of 2020 is Y Combinator. The list of Y Combinator’s companies that raised funds in 2020 includes Biotech companies such as Ginkgo Bioworks a Biotech which designs custom microbes to replace technology with biology, which raised $70M totaling $390M of funds raised. The latest investment round was backed by Illumina, General Atlantic, and Viking Global Investors. The 2020 list of successful portfolio companies also includes names such as Atomwise, a AI-focused Biotech which raised a $123M Series B Led by Sanabil and B Capital Group and joined by Data Collective DCVC, Tencent Holdings, Y Combinator, Dolby Family Ventures, and AME Cloud Venture, and also Truepill, a software-powered pharmacy which raised $25M Series B backed by TI Platform Fund, Optum Ventures, Initialized Capital, and Sound Ventures. Zenflow, a company developing a complications-free device for relieving BPH which Raises $31.4M in Series A Funding Led by Invus, F-Prime Capital Partners, and Medical Technology Venture Partners.

Other Y Combinator’s portfolio companies which raised financing in 2020 are Modern Health, a mental health benefits platform for employers closing a $31M Series B funding round led by Founders Fund, Carrot Fertility, Inc., a Digital Health/AI company developing global fertility solution for today’s employers, which received a $24 million Series B financing as well as BillionToOne, which received two funding rounds in 2020 to develop the first and only noninvasive prenatal screening for cystic fibrosis and spinal muscular atrophy. The first round was in March—a $15M Series A co-led by Hummingbird Ventures and NeoTribe Ventures and Joined by Y Combinator, Civilization Ventures, Fifty Years, 500 Startups, and HOF Capital. The second was half a year later—a $15M Series A+ Led by Hummingbird Ventures and NeoTribe Ventures and joined by Y Combinator, Libertus Capital and Pacific 8 Ventures.

QB3 follows with 31 portfolio companies raising funds. This research institute-cum-startup accelerator is home to some of the most innovative companies in the life science space, some of which it shares with other notable accelerators, such as BilliontoOne, Pionyr Immunotherapeutics and 4D Molecular Therapeutics, Inc—three companies also affiliated with J&J Innovation – JLABS, and Encoded Therapeutics Inc, a company working also with Illumina Accelerator.

The complete list of top ten most active life science accelerators and incubators since the beginning of the year are outlined in Figure 6.

Sectoral breakdown of companies successfully raising funds per each of the most active accelerators in Q3 2020 stays largely the same as in 2020 YTD (Figure 7).

Figure 7: Sectoral Split of Portfolio Companies Raising Funds in 2020 YTD; Source: CipherBio, November 2020

Figure 7: Sectoral Split of Portfolio Companies Raising Funds in 2020 YTD; Source: CipherBio, November 2020

Most Active Investors That Invest in Accelerator Companies – 2020 YTD

The CipherBio data platform shows that with a total of 37 companies, Y Combinator continues to be the most active investor financing companies affiliated with one of the top accelerators. It is followed by SOSV with its life-science focused program IndieBio (24), and Techstars (14). The complete list is provided in Figure 8.

Figure 8: Most Active Investors That Invest in Accelerator Companies As Measured by the Number of Deals (2020 YTD); Source: CipherBio, November 2020.

Figure 8: Most Active Investors That Invest in Accelerator Companies As Measured by the Number of Deals (2020 YTD); Source: CipherBio, November 2020.

Geographical Breakdown of Companies Admitted to Top Life Science Accelerators

The US remains the biggest hub of companies admitted to one of the top accelerators and incubators, with San Francisco (292) and Cambridge (112) and New York (105) being the three most active cities in the US. They are followed by San Diego (90), Chicago (84) and Houston (58).

In Europe, the most prominent locations are London (16), Dublin (8), Helsinki (7) and Paris (6), while in Asia, those are Shanghai (17), Singapore (11) and Mumbai (4) as demonstrated in Figure 9.

Figure 9: Geographical Breakdown of Companies Admitted to Top Life Science Accelerators as per Total Company Count; Source: CipherBio, November 2020.

Figure 9: Geographical Breakdown of Companies Admitted to Top Life Science Accelerators as per Total Company Count; Source: CipherBio, November 2020.

Top Life Science Accelerators Staying Strong in Challenging Times

CipherBio data demonstrates that top life science accelerators continue to be instrumental partners in the life science ecosystem in the difficult business environment that marked most of 2020. Essential in keeping the pipeline of new scientific, entrepreneurial efforts vibrant, they demonstrated the ability to secure the uninterrupted flow of innovations, critical not only as a key catalyst of economic growth but in the case of the life science ecosystem—as a driver of response to the unprecedented health crisis.

Figure 10: Funding of Companies Associated With Major Accelerators: Total Deal Count and Dollar Amount per Each 2020 Quarter; Source: CipherBio, November 2020.

Figure 10: Funding of Companies Associated With Major Accelerators: Total Deal Count and Dollar Amount per Each 2020 Quarter; Source: CipherBio, November 2020.

With almost 60 deals and more than $2B raised, the third quarter proves even stronger for companies associated with top accelerators compared to Q2 when around $1.7B was raised in almost 100 deals. CipherBio data indicates that the last quarter is on track to be a robust quarter, potentially leading to another record-high year.

As we move towards the end of the year, CipherBio will continue to track, aggregate, and analyze data across the whole life science spectrum, including those reflecting the top accelerators’ activities, to deliver new insights and help life science entrepreneurs and CEOs raise capital from venture capitalists.

To explore in-depth funding data involving the top investors, corporate VCs, accelerators and innovative companies as well as exclusive insights and key industry’s events and news, create your profile and join CipherBio data platform to access more than 6000 life science companies, over 3300 investors and 1600 global fundraising announcements.

Join us in our effort to capture the entire life science ecosystem in our database.

We strongly believe that the availability of a high-quality database about the life sciences ecosystem increases sector efficiency and benefits every company raising capital. Thus, if you are an investor or a startup in any of the relevant industries, we would like to extend an invitation to you to join the platform and or subscribe to the CipherBio insight newsletter.

Fill out your digital profile, or update it with your company’s latest news, so that you can be a part of the data set that represents the life science ecosystem.